The battle over drug pricing: Finally a consensus?

09 October 2019

The U.S.: The World Champion Of Healthcare Spending!

• Fitch Solutions expects the U.S. healthcare spending to grow to $3.6tn in 2019 from $3.4tn in 2018, or 18% of GDP.

• Most Americans have private health insurance provided by their employers.

• Only 36% of Americans receive public health insurance.

• MEDICARE: for the elderly and retired.

• It provides health coverage to the 65+ (or under 65 but with a disability).

• MEDICAID: for low-income individuals and families.

• Although prescription drugs only amount to 10% of total healthcare costs, the high price of many drugs is a significant matter ahead of the 2020 U.S. election.

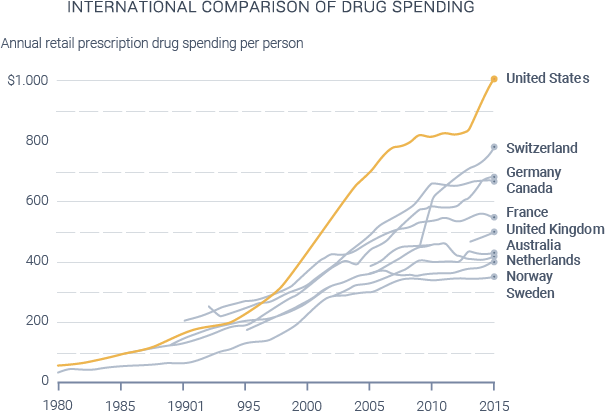

• U.S. prescription drug spending has been increasing faster than in most other countries.

• Americans pay the highest prices for drugs in the world!

• For 62% of U.S. voters, healthcare is the most or the second most important issue.

• Both sides (democrats and republicans) are proposing several bills to reduce prices, and may agree on a bipartisan plan.

The Pricing Drug Supply Chain: A Real Headache

• The U.S. is the only market in the world where drug prices are not controlled.

• If the government decides to change the rules, volatility in the stock market will be inevitable!

• Drug prices are set "behind the scene" through a complicated supply chain that involves three crucial players: pharmaceutical companies (i.e., drug manufacturers), pharmacy benefit managers (PBMs), and payers (private insurers, Medicare and Medicaid).

• PBMs act as middlemen and work on behalf of payers to negotiate discounts on the list prices of prescription drugs, called rebates.

• The drug manufacturer pays rebates to a PBM.

• The PBM shares the rebates with the payers (the insurance companies, but not with final patients).

• The rebates system aims at incentivizing PBMs and health insurers to include the manufacturer’s products on their formularies, i.e., the list of drugs and pharmacological therapies covered by a health plan.

• Different PBMs may negotiate different rebates, and this system remains very opaque.

• New drug pricing bills under discussion could require PBMs and drug manufacturers to disclose the discounts they are negotiating.

• Some more radical proposals also suggest that final patients should receive 100% of the discount.

Change Is Coming!

• Both political camps have made several proposals since the beginning of 2019.

• Nancy Pelosi (democrat) was applauded by President Trump when she presented her plan, confirming the willingness to resolve the issue of high prices in a bipartisan way.

• The main proposals of Pelosi's Bill are as follows:

• Medicare would directly negotiate the prices of at least 25 drugs with an upper limit of 250 drugs per year.

• The government would target the drugs that represent the highest costs under Medicare taking into account both price and volume sold in the U.S.

• An upper limit on prices that would be set at 120% of the average price of the drug in six reference countries.

• Once the negotiated price is set, the drug maker may not increase the price faster than inflation in subsequent years.

• Under the Part D Medicare program, an annual out of pocket maximum would be established at $2'000.

• A more restrictive view from the version of the Senate Finance Committee bill, where the proposed amount was $3'100.

• Companies that do not meet the requirements would have to pay penalties corresponding to 65% of gross sales of the drug.

• The bill proposal is less ambitious than expected and should not target rare diseases drugs (that are typically very costly).

• Big pharma companies are the most exposed.

Catalysts:

• A bipartisan agreement before the 2020 U.S. election is not a utopia anymore.

• Any deal would likely remove the uncertainty over pricing that has depressed pharma stocks.

• It appears unlikely that draconian measures will be adopted.

• With Trump's support, a compromise between the Senate Finance Committee bill and the Pelosi bill is likely to be found.

• The final bill could be less aggressive than anticipated by the market.

• Specific therapeutic categories (like cancer) remain protected by state legislation, and orphan drugs are protected by moral suasion.

Risks:

• A "no agreement" situation between the two political camps would lead to more volatility on the stock market.

• A price cap on orphan drugs and other strategic areas may still be added to the proposed bills.

• Extremely high prices for orphan drugs have recently made headlines and are becoming a public opinion debate subject.

Bottom line:

- Finding a compromise between the two political camps resulting in a bipartisan bill should be not as detrimental to the healthcare sector as anticipated.

- Drug stocks have been impacted negatively by the news flow about pricing discussions since the beginning of the year.

- Once the uncertainty over pricing and potential reforms will disappear, investor sentiment will significantly improve, and the healthcare sector may see a re-rating.

- Most innovative biotech companies are less impacted by a future bill on pricing than the largest pharma companies.

- Innovation will continue to drive the industry.

Sources:

https://theincidentaleconomist.com/wordpress/something-happened-to-u-s-drug-costs-in-the-1990s/

https://www.kff.org/other/state-indicator/total-population/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D National Health Statistics Group. (2017)

Wall Street Journal https://www.healthline.com/diabetesmine/pharmacy-benefit-managers-and-drug-pricing

Centers for Medicare & Medicaid Services

Explore:

Disclaimer

This report has been produced by the organizational unit responsible for investment research (Research unit) of atonra Partners and sent to you by the company sales representatives.

As an internationally active company, atonra Partners SA may be subject to a number of provisions in drawing up and distributing its investment research documents. These regulations include the Directives on the Independence of Financial Research issued by the Swiss Bankers Association. Although atonra Partners SA believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this report.

The information contained in these publications is exclusively intended for a client base consisting of professionals or qualified investors. It is sent to you by way of information and cannot be divulged to a third party without the prior consent of atonra Partners. While all reasonable effort has been made to ensure that the information contained is not untrue or misleading at the time of publication, no representation is made as to its accuracy or completeness and it should not be relied upon as such.

Past performance is not indicative or a guarantee of future results. Investment losses may occur, and investors could lose some or all of their investment. Any indices cited herein are provided only as examples of general market performance and no index is directly comparable to the past or future performance of the Certificate.

It should not be assumed that the Certificate will invest in any specific securities that comprise any index, nor should it be understood to mean that there is a correlation between the Certificate’s returns and any index returns.

Any material provided to you is intended only for discussion purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security and should not be relied upon by you in evaluating the merits of investing inany securities.

.png)

.png)