Telemedicine: A responsive call to healthcare needs

09 October 2019

When Healthcare Costs Go Up, Telemedicine Cuts Them Down

• In the U.S., the average yearly cost of employer-provided healthcare insurance for a family plan (four members) is now >$20k mark.

• Rising coverage prices paid by insurers and employers are significant drivers for healthcare inflation.

• According to the American Medical Association (AMA), telemedicine can help an employer save approximately $300 per year for a single employee or more than $1'000 per year for a family of four.

• Telemedicine is the use of Information and Communications Technologies (ICT) to improve patient services in terms of care and medical information access.

• When distance is a critical factor, the delivery of health care services can exploit ICT for diagnosing, treating, and preventing diseases and injuries.

• Telemedicine main features are:

• providing clinical support,

• overcoming geographical barriers,

• involving various types of ICT,

• improving health outcomes,

• reducing healthcare expenditure.

Is Everyone Ready For Not Visiting The Doctor?

• The global telemedicine market was valued at $21.45bn in 2018 and estimated to be worth $60.45bn by 2024, a CAGR of 18.50%.

• The U.S. is ready to expand customer adoption.

• 96% of U.S.-based large employers provided telehealth services in 2018.

• Telehealth Original Medicare (Medicare Part A & Part B) coverage has been until recently restricted to services offered in rural areas.

• Specific conditions apply about the venue where services are provided.

• Private homes are not included in Medicare reimbursement.

• Such restrictions will be lifted starting in 2020, when Medicare Advantage Plans may offer more telehealth benefits than Original Medicare.

• No matter where the customer is located, under Medicare Advantage, telehealth services will be covered, even if used at home instead of going to a health care facility.

• The state of California is likely to convert to law a measure that would require insurers to pay providers equally for telehealth and inperson visits.

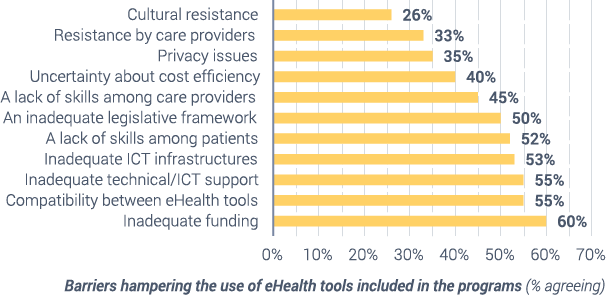

• Europe is slower in the adoption of telemedicine services.

• A weak regulatory framework, insufficient funding, and inadequate IT infrastructure are barriers to its widespread implementation.

Faster, Cheaper, Broader

• The United States market is currently the most active for telemedicine.

• Teladoc Health Inc. (TDOC US), American Well (not listed), Doctor on Demand (not listed), and MD Live Inc. (not listed) are among the most prominent players in the field.

• Some of these companies are expanding their worldwide presence by acquiring smaller competitors abroad - as it was the case for the French MédecineDirect, acquired by Teladoc Health.

• On average, a telehealth visit costs about $79, compared with about $146 for an office visit.

• Teladoc Health Inc. alone completed approximately 2.6mn telehealth visits in 2018, through a network of more than 3'100 health professionals.

• The company hires physicians as contract employees, leaving them flexibility in their practice.

• Physicians are paid $23.50 per phone visit and $28 per video visit - on average, they complete 3 to 5 video visits per hour.

• These companies distribute their offerings by being included in the health plans that insurers sell to employers.

• The advantages brought forward are a faster patient-doctor interaction for employees, lower visit expenses for employers/insurers, and broader patient coverage for physicians present on the platform.

• General health, global care, behavioral health, dermatology, and expert second opinion services are often available through telemedicine providers.

Catalysts:

• Advancements in the 5G ramp-up will allow faster and higher-quality connections, building an optimal channel for transmission.

• Remote locations currently served by a slow and intermittent, if not lacking, connection, will be effectively served by telemedicine services.

• Reimbursement decisions by both public and private payers.

• U.S. customers' usage is dependent on transparency and applicability of reimbursement for the category.

• Adoption will foster adoption.

• As with many new services, being considered reliable and conquering customers' trust is key to exponential growth.

Risks:

• Incumbent players may face unexpected competition from employers, providing themselves the services to their employees.

• Recently, Amazon launched Amazon Care, a virtual medical clinic dedicated to its employees.

• Any delays in developing the necessary infrastructure will impact the adoption rate growth.

• Slow or lacking connection still affects many potential users in accessing the services.

Bottom line:

- The rising necessity to keep costs under control, while offering improved health services, is boosting telemedicine take-off.

- In the United States, authorities are fostering telemedicine support through increased Medicare coverage effective from 2020.

- More partnerships between health plan providers and telemedicine players are helping extend population coverage and reach.

- Awareness about the efficiency and convenience of telemedicine is paving the way for users' adoption.

- The majority of the telemedicine players are still privately-held at the moment: American Well, Doctor on Demand, and MD Live Inc., to mention just a few.

- Teladoc Health (TDOC US) is the only opportunity to get a pure-play exposure to the sector, and is part of AtonRâ Bionics certificate.

Explore:

Disclaimer

This report has been produced by the organizational unit responsible for investment research (Research unit) of atonra Partners and sent to you by the company sales representatives.

As an internationally active company, atonra Partners SA may be subject to a number of provisions in drawing up and distributing its investment research documents. These regulations include the Directives on the Independence of Financial Research issued by the Swiss Bankers Association. Although atonra Partners SA believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this report.

The information contained in these publications is exclusively intended for a client base consisting of professionals or qualified investors. It is sent to you by way of information and cannot be divulged to a third party without the prior consent of atonra Partners. While all reasonable effort has been made to ensure that the information contained is not untrue or misleading at the time of publication, no representation is made as to its accuracy or completeness and it should not be relied upon as such.

Past performance is not indicative or a guarantee of future results. Investment losses may occur, and investors could lose some or all of their investment. Any indices cited herein are provided only as examples of general market performance and no index is directly comparable to the past or future performance of the Certificate.

It should not be assumed that the Certificate will invest in any specific securities that comprise any index, nor should it be understood to mean that there is a correlation between the Certificate’s returns and any index returns.

Any material provided to you is intended only for discussion purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security and should not be relied upon by you in evaluating the merits of investing inany securities.

.png)

.png)