Back to the future: Why trains are coming back

09 October 2019

Railway: The Most Environmentally Friendly Transport System

- The transport sector, accounting for more than half of global oil demand, is responsible for about 25% of world’s CO2 emissions

- In 2017, rail accounted for 9% of global passenger transport activity, but only 2% of transport related CO2 emissions.

- The rest of transport-related CO2 emissions were 77% from road vehicles, 13% from aviation, and 11% from shipping.

- Rail is today the cleanest mode of transport, thanks to its very high level of electrification.

- 86% of passenger rail transport and 50% of freight rail transport is electricity-powered.

- To move a step further, incumbents are switching power sources to renewable energy.

- In the Netherlands, for example, passenger trains are primarily powered by wind.

- In Switzerland and Sweden trains are powered at 100% on hydropower.

- In California, the San Francisco’s Bay Area Rapid Transit System (BART) recently agreed to derive at least 50% of its wholesale electric portfolio from renewable sources and at least 90% of it from low- and zero-carbon sources by 2025.

- Road congestion, as well as having a negative impact on the environment, has a major negative impact on competitiveness.

- The European commission estimates that road congestion costs around €130bn annually.

- Railways, can be a very appealing congestion-busting solution.

Railway: The Most Environmentally Friendly Transport System

High-Speed Rail Is At The Foundation Of Economic Growth

- OC&C estimates a 3.4% passenger CAGR from 2017 to 2022 in the top 5 European passenger rail markets

- Growth is driven by government investments and deregulation.

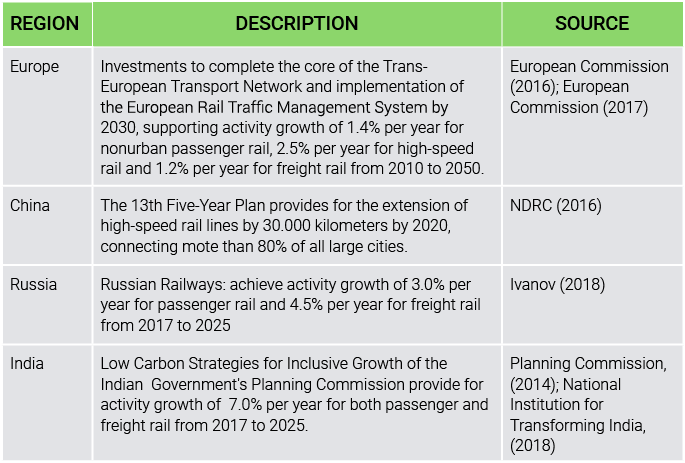

- In its base case scenario, the International energy Agency (IEA) expects global investments in the building, operating and maintenance of networks to represent $475bn of annual expenditures between 2018 and 2050.

- Around $315bn will be spent annually on rail infrastructure.

- During 2010-2015, the average annual investment in rail infrastructure was $200bn.

- Around $315bn will be spent annually on rail infrastructure.

- According to UIC, ECA and OC&C analysis, European rail investment planned until 2033 totals a cumulative >$400bn.

- The U.K. is expected to be at the forefront with $183bn.

- The total length of EU high-speed rail is expected to hit 21’000km by 2030, more than trebling from 2011 levels.

- The European Commission is renewing the 'Connecting Europe Facility', with a budget of €42.3bn to support investments in the European infrastructure networks

- This is part of the next long-term EU budget 2021-2027.

- Transport is the main beneficiary with €30.6bn.

- Ahead of energy (€8.7bn) and digital (€3bn)

.png)

New Rail Transport Technologies: Hydrogen Trains

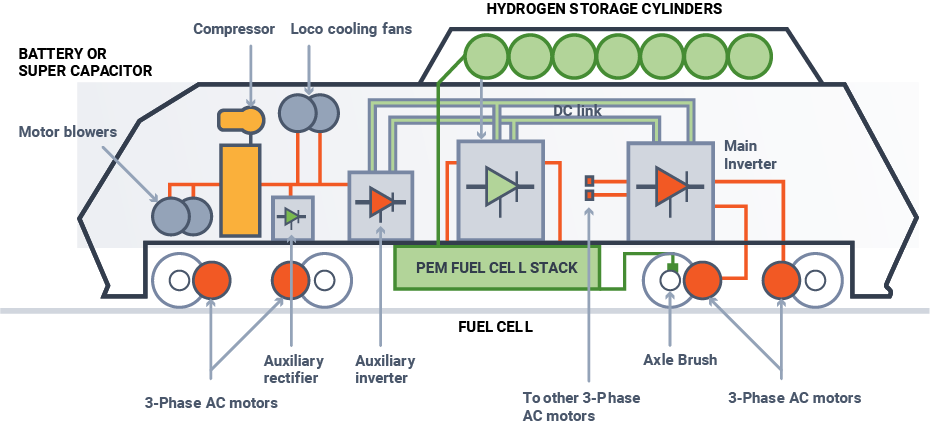

Hydrogen trains could replace current diesel locomotives, used in non-electrified part of the networks (50% of freight network is not electrified).

- The technology requires hydrogen mixing with oxygen produced from the air to produce electricity.

- The hydrogen is burned while excess energy is stored in a backup lithium-ion battery.

- No carbon is emitted; hydrogen trains emit water.

- They are cleaner, quieter and cheaper to run than diesel trains.

- They don't require expensive electrification infrastructure

- Alstom have already created the Coradia iLint passenger train models,

- It is the first passenger train in the world to be powered by a hydrogen fuel cell, which debuted in Germany last year and now runs a daily service.

- Britain expects hydrogen trains to be a reality by the early 2020s.

- To date, only 40 percent of the UK's railway is electrified, and the majority of trains run on diesel.

- Upgrading existing trains without having to electrify the railroads will save both time and money in meeting the 2040 goal of eliminating diesel engines from the rail network.

- Alstom have already created the Coradia iLint passenger train models,

Key Players

GREENRAIL (not listed)

- The company has developed a new kind of sleepers (the track substructure to which the rails are attached) made up of concrete and a mix of recycled plastic and rubber.

- It also integrates a photovoltaic module allowing to transform the railway into photovoltaic power stations.

- Their product is much more solid than a conventional concrete sleeper, allowing for reduced maintenance costs.

- It also brings a substantial reduction of the acoustic impact of the train’s passage

TRAINLINE (TRN LN) is the leading UK technology platform for train tickets purchasing.

- The company is a tech business, which is growing fast, highly cash flow generative with a robust transactional classified business model.

- The Trainline platform allows customers to search for ticket options across carriers and multi-modal forms of transport.

- It provides users with recommended journeys based on actual delays and disruptions and predicts prices allowing for finding the best possible fare.

- Penetration of online train ticketing is very low (39% vs Low Cost Air Carriers at 86% - source: OC&C, company information) in the €225bn global rail and coach market (source: OC&C).

ALSTOM (ALO FP) is one of the leading global innovative players in sustainable smart mobility.

- Alstom offers a complete range of solutions (from high-speed trains to metros, tramways and e-buses), passenger solutions, customized services (maintenance, modernization), infrastructure, signalling and digital mobility solutions.

WABTEC (WAB US) is a leading supplier of critical components, locomotives, services, signaling and logistics systems and services to the global rail industry.

- The U.S. Federal Railroad Administration has introduced recently a new high-speed standard, increasing the maximum speed limit to 220mph fostering railroads to upgrade their assets.

- All the 41 U.S. national rail systems are required to upgrade their assets and integrate the so called Positive Train Control (PTC) technology by 2020.

- This technology involves the installation of equipment on locomotives and tracks to monitor train speed and relative position.

Catalysts:

- Politics: Several recent developments, such as the establishment of the Fourth Railway Package’s technical pillar and of the S2R Joint Undertaking, support the creation of a Single European Rail Area (SERA).

- These schemes are already leading to an increase in the quality and choice of services available, more responsiveness to customer needs, and greater economies of scale.

- Diesel bans: In Europe a number of countries has come out with plans for banning diesel, which should boost demand not only for electrification but also for hydrogen trains.

- Behavioral change: The reduction in travel times may induce new habits, with distances of 200 km and more in everyday commuting becoming acceptable.

Risks:

- Digitalization will create new challenges, particularly in maintaining the security and integrity of cyber-systems.

- There are indications in some countries that commuting may be decreasing, reflecting the growth in home-working or reductions in the length of the working week.

- High-speed trains require high infrastructure construction costs - delays and cancellations may be likely given the complexity and the political nature of such projects.

Bottom line:

- The rising pace of urbanization will significantly increase the demand for efficient and sustainable transport solutions.

- Rail can respond efficiently to the scale of this challenge, being the only mode with the flexibility to serve significantly increased passenger and freight volume while reducing damaging impact on the overall urban system.

- In order to clean (decarbonize) the transport sector and support the so-called “green mobility”, railways will play an important role.

- By leveraging their unique advantages in moving people and goods along heavily utilized, high-demand routes.

- Rail passenger journeys in the World are reaching record levels and further investments planned on high-speed trains will accelerate this growth.

- We play this particular theme with investments in Trainline (TRN LN) and Wabtec (WAB US).

Sources:

IEA, European Federation for Transport and Environment AISBLEuropean Commision - Electrification of the Transport System, European Commision - https://ec.europa.eu/transport/themes/urban/urban_mobility_en

EU Transport in Figures, Eurostat Energy Statistics 2018, EEA 2017 (2014 data), IEA-UIC handbook, 2017

OC&C, EUROPEAN RAILWAY INFRASTRUCTURE: A REVIEW - Lucia Knapcikova and Rob KoningsUIC, ECA and OC&CEuropean Parliament - http://www.europarl.europa.eu/thinktank/en/document html?reference=EPRS_BRI(2018)628247, AtonRâ Research

Explore:

Disclaimer

This report has been produced by the organizational unit responsible for investment research (Research unit) of atonra Partners and sent to you by the company sales representatives.

As an internationally active company, atonra Partners SA may be subject to a number of provisions in drawing up and distributing its investment research documents. These regulations include the Directives on the Independence of Financial Research issued by the Swiss Bankers Association. Although atonra Partners SA believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this report.

The information contained in these publications is exclusively intended for a client base consisting of professionals or qualified investors. It is sent to you by way of information and cannot be divulged to a third party without the prior consent of atonra Partners. While all reasonable effort has been made to ensure that the information contained is not untrue or misleading at the time of publication, no representation is made as to its accuracy or completeness and it should not be relied upon as such.

Past performance is not indicative or a guarantee of future results. Investment losses may occur, and investors could lose some or all of their investment. Any indices cited herein are provided only as examples of general market performance and no index is directly comparable to the past or future performance of the Certificate.

It should not be assumed that the Certificate will invest in any specific securities that comprise any index, nor should it be understood to mean that there is a correlation between the Certificate’s returns and any index returns.

Any material provided to you is intended only for discussion purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security and should not be relied upon by you in evaluating the merits of investing inany securities.

.png)

.png)