Outlook 2021: is money still worth something?

16 December 2020

First and foremost, we would like to thank our customers for their renewed trust and our service providers for their commitment. Both are undeniably helping AtonRâ continue to strengthen its solid fundamentals.

The year 2020 was a historical one under many circumstances, even more so for AtonRâ. We successfully launched the AtonRâ Fund in July, which proved to be a very challenging endeavor for the company but also a very rewarding one: such an achievement wouldn't have been possible without our customers' trust. Here again, our gratitude goes to those historical and new customers that made achieving this milestone possible.

AtonRâ keeps on investing heavily in R&D as it has been doing for many years now. Even more today, our firm belief is that R&D represents the core of a resilient and sustainable business model. Likewise, we do the same with companies we consider investing in. While R&D is not always a guarantee of tangible results, low R&D is a guarantee of a dwindling business over time.

We are continuously improving the quality of our workforce and service providers, looking to strengthen teams across the company. In particular, we have expanded our team with the addition of several talented specialists. Going into 2021, we are looking forward to materialize some exciting projects we have been working on during the last few years. We will keep you informed about launch details.

AtonRâ wants to remain the reference in growth thematic equity investments and will make sure to keep on innovating and improving its service offering and stay abreast in this competitive market landscape.

At this same time last year, we questioned ourselves if the longest bull market in history had extra legs going into 2020 and advised to increase exposure to growth equities. Back then, we never thought a healthcare crisis such as Covid-19 would unfold.

We reiterated our long-standing conviction that technology is pervasive and becoming ubiquitous in everything we do. We highlighted the importance of technological innovations in the transition from a fossil-fuel era towards renewables. The Covid-19 crisis acted as a booster for all the investment themes that we manage. The world had to cope with the pandemic crisis with a different, tech-dependent, business model. Growth accelerated for many tech-related/high-growth names.

For the first time in history, we saw oil prices trading at negative values.

In a historical trading environment, we saw bonds' volatility on par with equities. Bonds experienced a liquidity crunch, while equity markets were the only ones operating correctly.

We experienced the shortest and deepest recession in a century affecting unequally different social groups.

In an unprecedented move, we saw central banks committing to easy money until inflation overshoots.

For the first time, European leaders were able to co-ordinate a joint fiscal stimulus program.

The biotechnology advancements were mind-blowing. The industry developed a vaccine in only ten months, whereas it would have taken up to ten years until not too long ago.

The critical question now becomes if such growth in technology and growth sectors is sustainable as we enter 2021 and beyond. Are markets already altogether discounting a massive recovery in earnings? In some industries, cyclicals notably, and some pockets of the themes we manage, this might be the case.

While the recovery will be robust and likely longer than anyone possibly envisions, some technological subsectors' growth will likely normalize going into 2021. Still, it will remain vigorous as key structural trends are here to stay. Everyone was forced to embrace the digitalization trend, especially the elderly, and adoption rocketed to unforeseen levels.

New technologies such as A.I., robots, cloud, data analysis, mobile for everything, etc., account for a larger (and increasing) pie of the GDP and have become an integral part of the economy. With this in mind, we wouldn't bet on a repeat of the Nasdaq sell-off of the early 2000s, as some analysts suggest, but believe that careful selection is needed. Dispersion of returns among the different sectors of the economy is likely to increase further. We believe that smart investors want to avoid as much as possible unsustainable business models, bubbles, and the Robinhood crowd.

Covid-19 exacerbated the fragility and anti-fragility of many sectors in the economy, such as onshore vs. offshore, e-commerce vs. brick and mortar, automation vs. manual, etc. It also proved that no one could afford the luxury of not embracing the ongoing technological transformation.

Once again, the debate around growth vs. value takes center stage. For many years, we have been saying that the concept of expensive vs. cheap is to be put in context. Cheap doesn't mean it's a bargain but simply that it is not worth more than the dime you pay for it, as deflationary forces are at play. Short-term inflation will be kept in check by slack in the labor market and accelerating technological innovations. We wouldn't rule out a rise in longer-term expectations upon a fiscal cliff and more robust than expected demand boost.

With central banks and governments which flooded the market with $11tn (13% of the world's GDP) of cheap money, the economic recovery should gain steam. For this to happen, the money has to flow from banks to the real economy by easing credit conditions.

Financial markets are forward-thinking, and the focus will be on the political measures undertaken to sustain economic growth, in addition to the eventual unintended consequences. We believe (and the reason behind this paper's title) that erosion of the perception of the value of money, and the possible lack of confidence in it, represents a substantial risk.

In a paper written in March 2020, we stated that the Covid-19 crisis is temporary. Still, policymakers' measures across the world will provide a considerable boost for the longer term. It will take some time for those measures to filter into the real economy, but it will also be challenging and long to scale them back.

Worldwide GDP is likely to contract by 4.5% in 2020 or to the tune of $3.9tn. If all the available money ($11tn) all of a sudden comes to the market and chases the same assets, no one needs to have a Ph.D. to understand what comes next. With savings rates also at historical highs and the desire to return to a "normal" life when the economy reopens, the result could be a surge in spending, inflation pressure and, consequently, a meaningful steepening of the yield curve.

In a world with $17tn of negative-yielding debt and a free money environment, high-quality growth stocks are, in our opinion, safer than bonds. They offer a much better risk-adjusted return, notably if yields increase. A shift from bonds to quality growth stocks could be in the making?

We believe that anyhow a shift to equities (and tangible assets in general) is likely to happen in the not too distant future. And those investors who have learned the lessons from history are to command a higher liquidity premium for holding bonds.

We reiterate our conviction that holding tangible assets is the best option and the least risky one in this economic environment. While some investors might see gold as the asset to own if inflation expectations are picking up, we believe stocks (and digital currencies) offer a better value proposition. Gold (and precious metals in general) works very well in a negative real interest rates environment and not if the purchasing power (through higher yields) increases.

The last part of this writing will cover a 20'000-foot view of the themes that we manage. Our customers will receive a much more detailed report in the coming days.

We all experienced an exceptional year, and we all need to rest. May this particular part of the year bring you all joy and peace of mind.

Stefano Rodella & the whole Team of AtonRâ Partners

AtonRâ Themes: 2021 overview

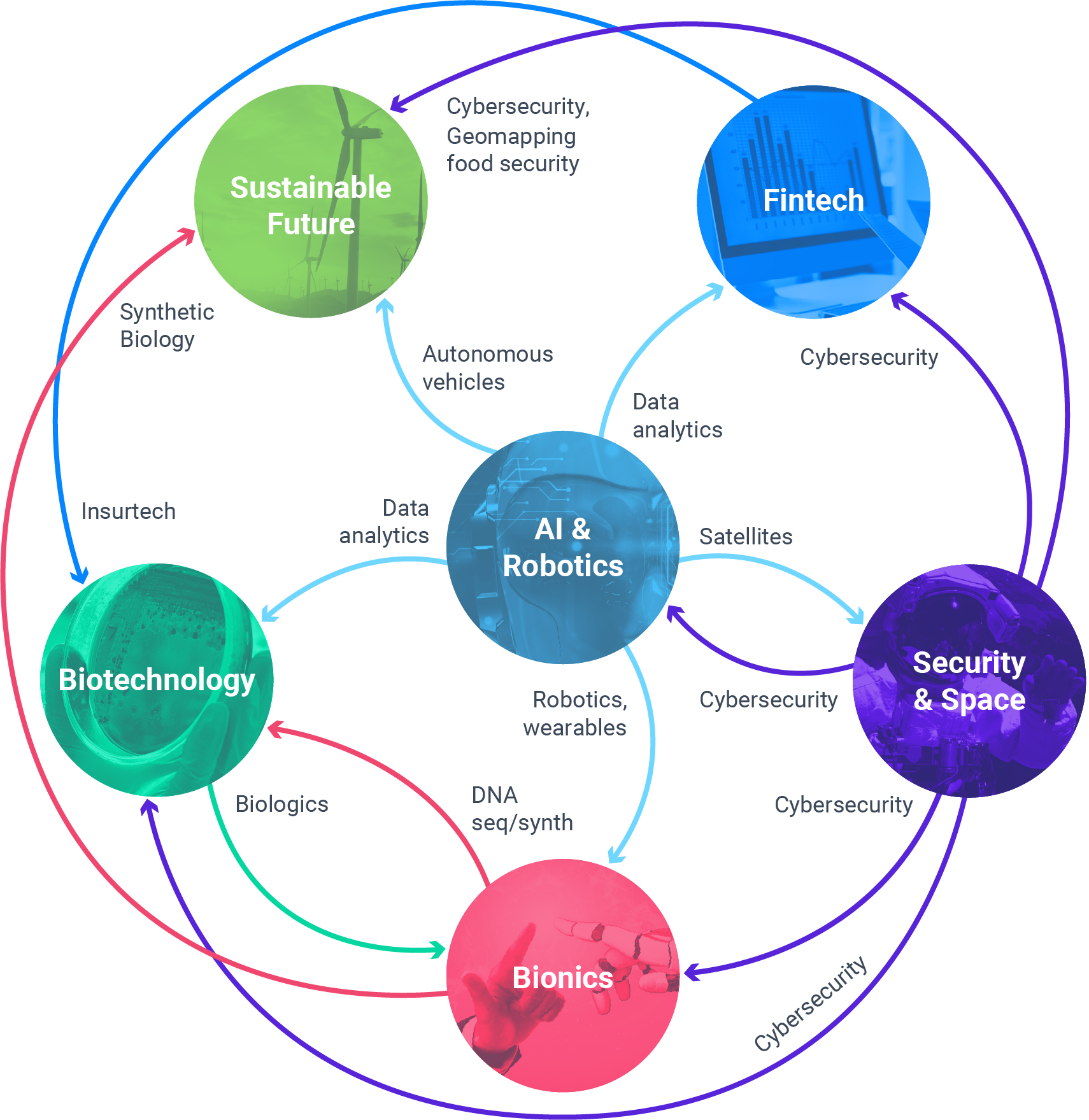

As technology adoption increases, so is the correlation and interdependence among different parts of the economy and the themes we manage. In no circumstances it means that all the investment themes have the same cyclicality and maturity.

Artificial Intelligence & Robotics

- China's first-in/first-out management of Covid-19 allowed the country to accelerate investments in A.I. & Robotics, reinforcing our positive view on the region.

- The pandemic validated the cloud's value proposition, propelling the cloud market above $300bn in 2021 (20% faster growth than previously expected).

- Edge computing represents a $100bn opportunity by 2025, growing at 50% CAGR beyond personal computers and mobile terminals. Edge deployment got delayed by the limits of the current networks and low-power processing technologies.

- Emerging Natural Language Processing (NLP) engines (pushed by Microsoft, Google, Facebook) are massively available to unlock new use-cases for knowledge automation applications. NLP serves as the foundation to accelerate multiple A.I. fields.

- Cloud software specializing in robotic process automation (RPA) has been under the spotlight in 2020.

- As sensors and computing power get cheaper, the adoption of industrial robots, cobots, and chat-bots becomes increasingly pervasive, sparking a new era in human history.

- Laser sources are core elements of 3D sensing systems. As Lidar sensors get cheaper, they get ubiquitous in consumer devices, autonomous vehicles, and collaborative robots.

- A.I. and Bionics augment humans and transform prosthetics' capabilities with applications in cognitive, ophthalmic, motor, and auditory disorders.

Bionics

- This industry demonstrated its value proposition during the pandemic, reducing healthcare costs while improving quality of life.

- Telemedicine and remote monitoring underwent a metamorphosis. Regulatory bodies eased rules while payors upped reimbursements, likely to become permanent. Wearable devices are now connecting with smartphones, eliminating the need for dedicated monitors.

- A revolution in medical oncology and bio-production is in the making. Innovation is disrupting traditional medical device makers who are getting faster reimbursements.

- Redesigning microbes using synthetic DNA is no longer a matter of if but when. As the price of DNA synthesis continues to drop, new products will reshape the future of Healthcare.

- The first Next-Generation Sequencing liquid biopsy test was approved this year, unlocking the full potential of personalized cancer vaccines, prenatal diagnostics, and many others.

- The digitalization of Healthcare is at full speed. Smart medical devices are expected to increase and expand the total addressable market significantly, but careful selection is more than ever required.

- Machine Learning entered the labs, and no one could avoid it.

- The ongoing momentum for diabetes-tech and artificial organs is likely to accelerate going into 2021 and beyond as favorable reimbursement policies and lower prices accelerate their adoption.

- The global supply chain has shown its limits during the healthcare crisis. The medical 3D printing industry took its chance by supplying hard-to-have medical devices and changing the industrial landscape forever.

Biotechnology

- The Biotech sector responded swiftly in tackling the Covid-19 pandemic crisis. Having a vaccine available in only ten months vs. the standard ten-year pathway represents a significant catalyst for this theme.

- The pledge of public money into the private sector has long-term implications. It fuels the R&D engine way beyond Covid-19, as the consequences of social distancing could increase the prevalence of psychiatric and neurological disorders.

- A.I. comes as support from the discovery phase to the clinical stage and commercialization. It allows picking the best biological targets while fast testing such targets. Google solved a 50-years old issue, predicting protein-folding correctly, and might start in-house efforts or selling drug discovery services to Biotech companies.

- Oncology remains the most important therapeutic area but also the most competitive one. Successful investment in companies achieving commercial success is more challenging than ever, but immuno-oncology momentum should continue.

- The year 2021 might be CRISPR's year as following the success of CAR-T cell therapies in 2017 and RNA-based drugs (Moderna, BionTech) in 2019, the market is searching for the next gem. Furthermore, CRISPR is entering into the clinical phase.

- The $100 genome bar is nearing and would pave the way to affordable sequencing for all. Together with cheap wearables, it would open the doors for personalized medicine.

- Half of the approved drugs involve clinical studies enrolling fewer than 500 patients. With this in mind, small biotech companies are less eager to sell out to larger companies. Thanks to established players in the outsourcing space and thanks to healthy capital markets (a record year for Biotech IPOs), such companies could pay for their clinical studies.

Fintech & Mobile Payments

- In this investment theme as well, Covid-19 acted as a formidable accelerator. The lockdown boosted the adoption of e-commerce and digital payments with it. It has enabled digital banking adoption (think about trading platforms such as Robinhood) and a surge in new users. The fastest-growing demographic was people over 50 years of age.

- Blockchain might very well disrupt payments, trading, insurances, lending. Ethereum 2.0 is to improve blockchain scalability issues, and slowly but surely, real-life applications of blockchain are getting implemented.

- With Biden as the new U.S. President, more financial regulation is likely. The Chinese also gave an example of what is to come next with the aborted Ant Financial IPO. They opinioned that these companies need to regulate as financial companies. Stricter regulation is not necessarily bad for the theme as consumers would better trust more regulated companies. It might very well act as a catalyst for some subthemes we have exposure to.

- Upgrades by financial institutions are to intensify next year as real-time, account-to-account (A2A), and "buy now, pay later" payment methods are getting ubiquitous.

- The public investment universe is expanding as there were 70 Fintech unicorns at the end of Q3-2020 vs. 58 as of Q3-2019. An extended investment universe represents an excellent opportunity for our Fintech theme.

- Banks reduced their innovation budgets during the financial crisis, triggering the first wave of fintech players. They cannot repeat the same mistake nowadays and need to get rid of the legacy systems they still have if they want to have a chance to remain in business.

- Open banking is all about clients having control of their data. The infrastructure allowing the connection of all actors is based on application programming interfaces (APIs). Financial institutions not embracing APIs are tomorrow's losers.

Security & Space

- Covid-19 accelerated digitalization and the transition to the cloud. It will also accelerate cloud cybersecurity. Failure to appropriately encode or delete data in the cloud allows criminals to access data more easily versus hacking into a user's device. Covid also increased the demand for satellite imagery to monitor the outbreak and its impact on human activity and the environment.

- Space exploration, communication, and defense have the most significant sources of upside. Space travel generates high hopes to extend the addressable market, and 2021 may mark the first commercial launch.

- SpaceX, which leverages its ability to reuse launchers and declining launch costs, is gaining speed. At the same time, most of its competitors accumulate technological lag, project delays, and cost overruns. Next year will see the LEO constellations' launch of commercial broadband service with better quality and lower price than GEO services, a real game-changer.

- Smart locks, remotely controlled devices allowing couriers to deliver packages inside your house (lower risk of potential theft), are set to go off next year. Smart locks could be the fastest-growing segment within the smart-home security space.

- Cameras (including thermal cameras) and sensors will remain in high demand for home safety and surveillance. The number of seniors is to increase by 15% in 2021, driving demand for safety solutions.

- Fully Homomorphic Encryption (FHE) is a revolutionary approach that allows information to be processed while encrypted, hence never revealed.

Sustainable Future

- Many governments have announced economic recovery packages, with some of them explicitly targeting clean technologies growth. Europe unveiled the most significant green stimulus plan in history, with 37% of the announced €750bn going to climate-related expenditures. Climate-related infrastructure generates millions of jobs as every $1m of investment creates 10 to 15 jobs.

- Covid-19 gave us a glimpse of the future of the power markets. Lower operating costs of renewables helped them increase their share in the power mix during the pandemic. They were the only power source experiencing higher demand (up 7%) this year. It gave us a live test of power systems, with intermittent renewables challenging the electricity supply continuity. Smart Grids and energy storage solutions improve grid resilience and reliability.

- Many countries start to envision offshore wind as an attractive way to decarbonize the power sector. The technology is ready for take-off. The U.K. intends to reach 40GW by 2030 (from 10GW today), and the U.S. wants to achieve 100% carbon-free electricity by 2035.

- Solar photovoltaic (PV) is also becoming competitive with the marginal cost of operation of some fossil-based power generation plants (and not only on a new-build basis). It represents a significant catalyst for solar PV demand.

- Despite the great potential of green hydrogen, the ongoing hype does not match the current technology state. For green hydrogen to become competitive with grey hydrogen, upfront capital costs must fall 75%, and renewable electricity costs should be $2 cts/kWh (vs current $7-8 cts/kWh at best).

- Electric vehicle (EV) adoption depends more on model availability, driving range, and environmental concerns, than oil prices.

- Technology comes to the rescue of better energy efficiency. Wide-bandgap semiconductors (e.g., silicon carbide) used in power electronics provide better efficient electricity usage.

Explore:

Disclaimer

This report has been produced by the organizational unit responsible for investment research (Research unit) of atonra Partners and sent to you by the company sales representatives.

As an internationally active company, atonra Partners SA may be subject to a number of provisions in drawing up and distributing its investment research documents. These regulations include the Directives on the Independence of Financial Research issued by the Swiss Bankers Association. Although atonra Partners SA believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this report.

The information contained in these publications is exclusively intended for a client base consisting of professionals or qualified investors. It is sent to you by way of information and cannot be divulged to a third party without the prior consent of atonra Partners. While all reasonable effort has been made to ensure that the information contained is not untrue or misleading at the time of publication, no representation is made as to its accuracy or completeness and it should not be relied upon as such.

Past performance is not indicative or a guarantee of future results. Investment losses may occur, and investors could lose some or all of their investment. Any indices cited herein are provided only as examples of general market performance and no index is directly comparable to the past or future performance of the Certificate.

It should not be assumed that the Certificate will invest in any specific securities that comprise any index, nor should it be understood to mean that there is a correlation between the Certificate’s returns and any index returns.

Any material provided to you is intended only for discussion purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security and should not be relied upon by you in evaluating the merits of investing inany securities.