Is it the end of growth strategies? Don’t count on it!

07 May 2021

Current market uncertainties and risks are pushing investors to question the sustainability of growth strategies.

Bottom line

With the specter of higher inflation and rising interest rates, growth strategies risk facing strong headwinds. We have taken the time to assess all our portfolios and strategies, and present in this note a comprehensive overview of the outcome. For those that have been waiting to enter growth strategies, a mid-term opportunity is finally at hand.

Introduction

During the first quarter of 2021, one of the risks highlighted in our annual outlook, namely a rapid rise in real rates, did materialize. Consequently, our thematic growth portfolios suffered starting in mid-February.

The “rotation trade” favoring companies from the reopening of the economy came as another drag on our investment themes. The current economic boom put the global supply chain under pressure, hampering fast-growing players to meet the underlying demand.

Biden’s tax proposal to overhaul capital gains and corporate taxes to fund his $4tn economic agenda also acted as a sell catalyst. While

Mr. Biden’s final goal to narrow the income and wealth inequalities exacerbated by the COVID-19 crisis is laudable, the unintended consequences (if not well thought and detailed) are likely to bring the opposite desired results over the mid-to-long term. We believe that it pushes corporations to do more with less namely, to push for more automation.

The sell-off in growth stocks was further compounded by deleveraging (e.g. Archegos) and bubble-like behavior in some asset classes (e.g., SPACs).

In the following pages, we present our investors the outcome of the assessment we performed for all our strategies in the current market environment.

On many occasions, people predicted the end of growth strategies after a period of relative underperformance (e.g., 1H 2014, 2H 2016), only for these strategies to make a comeback. This time is no different in our view as the world’s future will simply have more technology. The underperformance of growth stock combined with strong Q1 earnings and growth expectations provide investors with a much better entry point, especially in terms of valuation.

At AtonRâ, we focus on the world’s global trends that will shape our future. For years to come, the global movement is indisputable: more technologies, more healthcare, and more renewable energy.

There are, and there will be some speed bumps along this journey. Still, we all aim to live a longer, healthier, and easier life, all in a responsible manner toward our planet – and technology is what enables all this to become a reality.

Financial metrics

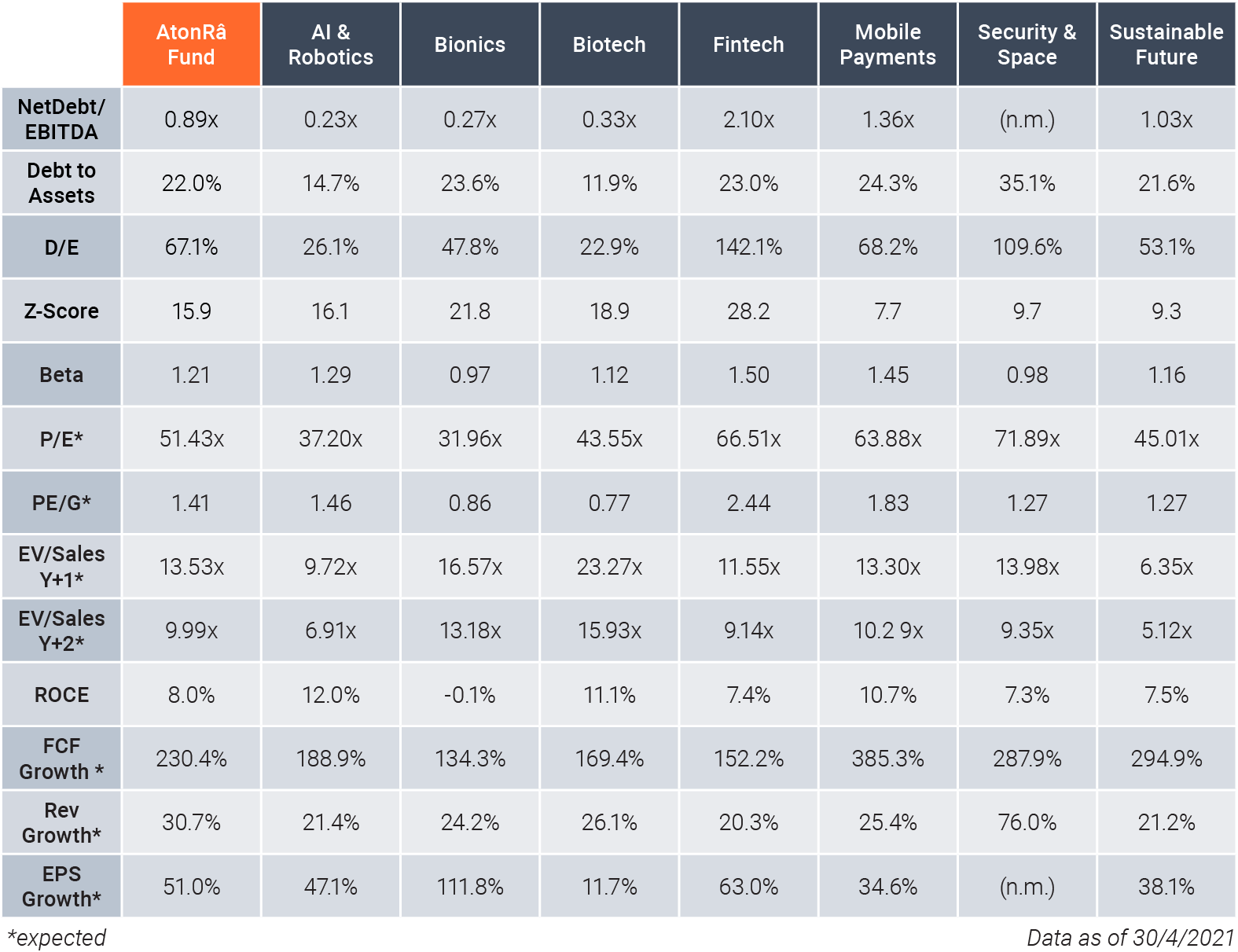

We deem noteworthy to provide a quick summary of the financial metrics of our thematic portfolios to better understand their profiles. We believe that paying on average 1.4x PE/G in long-term growth themes like those we manage represents a bargain opportunity in terms of valuation. In fact, value sectors are now trading for the most part at >2x growth. Furthermore, the quality of companies making up our portfolios is exceptionally high. Looking at the leverage ratios and the indicator of bankruptcy (Altman’s Z-Score), we observe that all our portfolios exhibit a solid ability to service debt, show overall low debt levels, and are at a minimum close to no risk of default. Last but not least, it is worth noting that companies that make our themes are carefully considered based on numerous efficiency, profitability, and growth metric. This reflects in solid ability to generate strong free cash flows, high return on employed capital, and promising revenue and earnings growth, especially if compared with the broad market.

Macro

We continue to expect higher rates and transitory inflation due to the surge in demand, supply chain disruptions, and base effects. Higher growth, fueled by reopening and loose monetary and fiscal policies, is impending. Equities and notably high-growth sectors are the end-beneficiaries of such a trend.

What happened

During the first quarter of 2021, the rapid rise in interest rates drove a market rotation out of growth and into value stocks, compounded by the “reopening trade” favoring those stocks that had suffered the most from the consequences of the pandemic.

Impact on our investment thesis

At the beginning of the year, we wrote that “Many global structural ingredients remain supportive for the equity markets. Innovation is bound to continue across sectors, and thus accelerate growth […]”.

The case for growth has only become more robust. But the pandemic base effects and higher input costs, from higher commodity prices and supply chain disruption coupled with a surge in demand during the reopening have also spurred talks of an inflation spike and a consequent rate increase. In this context, the aggressive money flood from monetary and fiscal policies worldwide is seen as suggesting high inflation is around the corner.

As explained in our latest publication, we expect any high inflation to be transitory. Indeed, initial conditions that led to past episodes of high inflation, such as strong demographic or low debt-to-GDP, are currently absent. Moreover, there are structural forces that remain deflationary, notably technological innovation.

Nevertheless, we expect that the inflation narrative will not disappear and is likely to stay for the medium term even if it does not materialize (as was the case right after the 2008–2009 financial crisis and the beginning of extremely accommodative monetary policies).

Our takeaway

Some investors are reassessing their asset allocation and divesting from growth and the tech sector, which is the most exposed to a rapid rise in rates. However, higher inflation in tandem with high growth is not necessarily bad for equities. Quality growth offers the best of two worlds: exposure to the acceleration in growth (driven by the reopening) and structurally good companies generating positive cash flows being among the best real assets.

AI & Robotics

An historic boom in demand brought the global supply chain to its knees, preventing industry players from fully serving the market.

A healthy transition is underway towards the next super-cycle.

What happened

The global economy is experiencing the biggest boom in more than a decade. Consequently, suppliers’ delivery time has been lengthening to a record level and input costs rising. Demand/supply imbalance is especially evident in the semiconductor industry.

Demand is 10% to 30% above supply, and shortages tend to generalize, negatively impacting the global supply chain and fueling inflation concerns.

As the industry is not meeting demand, revenue growth got hampered. Governments and companies are committing massive investments in infrastructure, compounding the demand. As the U.S. and China firmly engage in a post-COVID-19 world, industrial investments ramp up to drive +50% growth for robotics, 5G, and the data center infrastructure.

Impact on our investment thesis

In December, we envisioned an acceleration of the infrastructure phase. We were spot-on.

We believe that the surge in demand is non-fungible. It results from a profound acceleration of digitalization and automation, driven by the divergence between a fast-growing on-demand economy and a declining labor force. Historically, labor shortage caused parabolic returns for tech companies, and we believe this time is no different.

Cloud services are accelerating growth (above 40% YoY), driving strong demand for cloud infrastructure (+66% YoY in China).

Robotics is recovering from a low 1Q 2020 (with China doubling year over year). The semiconductor industry has been ramping investments with the support of public bodies. As manufacturing capacity does not come online overnight, the shortage will last for the best part of 2021, lengthening the period of uncertainty.

Current turbulences in the global supply chain exacerbate the strategic value of semiconductor, computing infrastructure, and industrial automation. The competition between U.S. and China adds a pinch of risk to the global ecosystem yet drives innovation and additional demand for technology.

Our takeaway

Industry comments confirm the overwhelming underlying demand for artificial intelligence and robotics, also seen through a solid earning season. We believe the market is supply-limited and going through a healthy reset as a premise of a renewed super-cycle.

Beyond current turbulences, electronic components (~50% of our existing AI & Robotics portfolio) will benefit from a perfect storm of increased prices, operational leverage, and sustained demand as CAPEX and the technology roadmap remain disciplined.

Additionally, we believe robotics and process automation face a generational opportunity as industrial output catches up with demand and governments recognize the opportunity.

Artificial intelligence and robotics are the foundation of modern digital economies and the source of global competitive advantage. We believe that both top-line and EPS growth are poised to accelerate, driving high-quality growth.

Bionics

The MedTech sector has proven to be a resilient ally to current global circumstances. We believe that innovation in medical technology is to play an even more critical role in today’s society.

What happened

After a strong 2021 start, the MedTech industry took a hit in February and March before bouncing

back during April. While this picture looks bumpy, the first quarter has witnessed new product launches, positive results from clinical trials, increased reimbursement coverage, and strong M&A activity, strengthening the industry fundamentals.

Impact on our investment thesis

Over the next few days, the Centers for Medicare and Medicaid Services (CMS) will decide the fate of a new rule granting instant national Medicare coverage to innovative medical devices. This is one of the most important and powerful short-term catalysts for the

Bionics theme, should the decision be favorable.

Meanwhile, new technology still benefits from other reimbursement pathways (e.g., CMS has recently proposed increasing reimbursement for Shockwave’s coronary intravascular lithotripsy technology via the New Technology Add-On Payment process).

MedTech companies have been rolling out a set of innovations at a fast pace (e.g., the launch of new neurostimulation devices and mini-invasive treatments for coronary diseases) during 1Q 2021. Positive clinical data has also been a significant tailwind for this space (e.g., NovoCure’s interim results on LUNAR trial – see our dedicated note).

The COVID-19 pandemic has created unprecedented deal-making opportunities. Digital health, especially cardiac monitoring devices, and in-vitro diagnostics, have been hot areas of M&A activity. We expect the industry to continue inking deals in these fast-growing sectors.

COVID-19 test volumes may start to fall as vaccination progresses, leading to a rebound in the liquid biopsy demand. During this quarter, a wave of liquid biopsy products has already hit the market, and a set of critical clinical milestones are expected.

Social distancing measures have been a strong catalyst for wearables and remote monitoring adoption. Many companies have accelerated their digital health investments, especially in diabetes and cardiovascular space. The COVID-19 vaccine rollout and the new entry of Amazon into the telemedicine space shacked up the sector. We see Amazon’s competition as a positive for the industry as it may discourage the entry of new players and trigger consolidation through M&A activity.

Our takeaway

We strongly believe that innovation is the key to adapt in a fast-changing environment while sustaining long-term growth and returns. In our view, the upcoming reimbursement changes can stimulate the U.S. medical device sector, offering a great entry point for investors.

The demand for medical devices has remained strong, especially for debilitating or life-threatening diseases, such as cardiovascular diseases. We expect the industry to continue to be driven by new product launches, clinical milestones, and geographical expansion rather than macroeconomic cycles.

Biotech 360°

Biotech is finally putting the “tech” front and center, and while all eyes are on drug price pressure, innovation is booming thanks to the meteoric rise of R&D enablers.

What happened

As we move through 2021, performance for the year for biotech stocks has been slightly lagging the broader healthcare and technology indices. This sector underperformance was mainly driven by the smaller, primarily clinical-stage drug makers.

Impact on our investment thesis

On the regulatory front, both the FTC and FDA have been taking a firmer stance against private players. On the FDA front, major drug approval setbacks (AbbVie, Acadia, Fibrogen, Merck, etc.) transformed into a sectorial headwind, which we believe is the result of both overwhelming pandemic-related workloads on the agency and lack of clear leadership following the presidential transition. Our integrated, tech-centered strategy focus has provided a broader and, more importantly, diversified exposure to the biotech space, still benefiting from solid innovation fundamentals across the board.

The pricing environment was mixed between drug developers and R&D enablers. Drug makers suffered from the democratic drug-pricing rhetoric that materialized through the “blue sweep” election outcome, proposals currently on the table relate to aligning drug prices to an international price index. Conversely, diagnostic companies, part of our R&D enablers universe, profited from reimbursement tailwinds acknowledging their core contribution to patient outcomes.

Currently, an unforeseen headline risk about removing the IP rights of COVID-19 vaccine makers during the pandemic period is unfolding. In our view: it could be a major transformative event favoring our approach. Biotech companies will be incentivized to have a stronger technological edge, and the entire value chain from laboratory tools to manufacturing suppliers will gain extra traction. A situation we have seen happening in semiconductor where big integrated companies are losing the race to a constellation of thriving specialized companies and suppliers with a strong technological edge.

The financing environment shows long-term appetite, with the top 10 early-stage biotech IPO’s raising $3.6bn in 1Q. CRO/CDMO businesses such as Wuxi Biologics show strong growth as they benefit from robust financing for drugmakers and the consequent increase in pipeline breadth.

Last but not least, the Chinese biotech market continues booming. Following an incredible 2020 with >250 partnerships with worldwide biotech companies and $29.3bn raised, 2021 is going along the same path with even larger deals being announced. Our portfolio captures the competitive advantage accruing to innovative Chinese drug developers while their western counterparties suffer pricing pressure.

Our takeaway

Biotech is embracing the “tech” in biotech, giving rise to innovative R&D enabling technologies. This changing investment perception of the whole industry will not take long to materialize, and we constantly position our portfolio to capture the opportunities spanning from this process.

Our Biotech 360° approach, investing not only in drug developers, minimizes headwinds while surfing on all tailwinds by investing in tech platforms, R&D enablers, and including exposure in China. We believe the reports of growth strategies’ death have been greatly exaggerated and that our portfolio is ideally positioned to capture growth and value in the entire drug development ecosystem.

Fintech

Banks beware! New fintech companies and the latest blockchain developments will disrupt you all.

What happened

In January 2021, we repositioned our fintech portfolio towards the “new fintech” rather than the “old fintech.” At the same time, we also initiated positions in blockchain-related companies. The recent developments in blockchain confirm our idea that this technology can disrupt the financial industry as we know it.

Impact on our investment thesis

According to CB Insights, the fintech industry attracted a record level of funding in 1Q 2021 (approx. $23bn). Fintech is not only driving capital but also maturing. Mega-rounds (>$100mn) and exits heat up – via traditional IPOs and SPACs. Even though the latter took a hit following the latest guidelines from the SEC regarding the accounting treatment of warrants, our investment universe is expanding and offers new opportunities. Robinhood, Chime, or Marqeta will soon join SoFi, Lemonade, or Coinbase as publicly listed companies.

These challengers are pure growth players: double or triple-digit top-line growth with heavy investments in R&D at the expense of profitability. They improve the lives of underbanked people and are gaining market shares from incumbents. They rely on the latest technologies, developed in-house or with the support of technology enablers, to provide the best user experience in a world where in-person banking is dying.

Following six consecutive positive monthly returns for Bitcoin that multiplied its market cap by ~6x, the leading cryptocurrency paused in April (-3.6%). High beta companies, e.g., Bitcoin miners, sold off sharply. Moreover, the mixed debut of Coinbase attracted investors looking for an alternative proxy exposure into digital assets.

A paradigm shift is undergoing as institutional investors and corporate treasurers are piling into Bitcoin. The cryptocurrency has gained asset-class status and is becoming a store of value boosted by monetary and fiscal interventions.

Looking beyond cryptos, we noticed a multiplication of blockchain projects making financial transactions more efficient. The merger of traditional and digital financial markets has started. The first live trades to settle in T+0 on U.S. listed equities used blockchain technology. The European Investment Bank registered its first bond on the Ethereum blockchain. Tokenized stock tokens, which could allow 24/7 trading, went live on Binance and other digital exchanges.

Our takeaway

As JPMorgan CEO and chairman Jamie Dimon rightly said in its last annual shareholder letter, fintech is an “enormous competitive” threat to banks. Fintech is democratizing and increasing the addressable market of financial services with payments, investments, loans, and insurances becoming intuitive. We believe this is only the beginning as in the longer run, the development of blockchain protocols will accelerate the digitalization of the real world.

Mobile Payments

COVID-19 boosted mobile and digital payments. The aftermath of the pandemic will confirm the transition to cashless societies.

What happened

According to Worldpay, the use of cash at physical stores went down from 30% to 20% in 2020. COVID-19 accelerated the transition to a cashless world. For the first time, digital and mobile wallets outpaced cash. Digital payments are expected to account for ~90% of the total volume processed globally by 2024. Consequently, payment processors are having a good run.

Impact on our investment thesis

Payment processors have been reporting very promising results year-to-date. The processed volume is rising across the globe. They can rely on a strengthened user base following the COVID-19 crisis that has encouraged many users to switch their payment habits towards digital methods.

Although the outbreak is still out of control in many places, vaccination campaigns in developed countries finally allow for a relaxation of the lockdown measures. Economies are reopening. Coupled with stimulus checks and other fiscal incentives, all the ingredients are there to boost consumption.

The global growth of mobile payments is slowing down, especially in countries with high penetration rates, such as China, where mobile payments will account for ~60% of sales by 2024. There is obviously more growth potential in regions like Japan, LatAm, and

Southern Europe, where mobile wallets penetration is still low when compared to some others.

In addition to digital wallets, payment cards face increasing threats from new payment methods combining, for instance, digital payments and credit. The boom in Buy-Now-Pay-Later (BNPL) platforms is only starting. This digital payment method has the highest growth potential in the years ahead.

Our takeaway

Our mobile payment portfolio is well-positioned to capture the accelerated transition to cashless societies through its significant exposure to payment processors and benefit from the reopening of the economy.

Tactical plays on regions that still rely on the use of cash bring additional growth to a strategy that has entered its last phase. In contrast, the fintech strategy keeps exposure to the mobile payments market leaders and invests in some promising Buy-Now-Pay-Later companies.

Security & Space

As economic life and security increasingly rely on digital and space ecosystems, security and space industries are bound to expand significantly despite recent volatility and uncertain market sentiment.

What happened

With the global turbulence in the financial markets and notably in “growth” stocks, we have observed a switch from higher-priced cloud-software stocks to legacy enterprise companies trading at lower

valuations. Simultaneously, the space industry has gained traction and attracted “New Space” companies to join the public markets via SPACs. Consequently, this segment started to exhibit a bubble-like behavior destined to deflate.

Impact on our investment thesis

The constant newsflow about new vulnerabilities, massive data breaches, and significant disruptions caused by cyberattacks reinforce our investment thesis that cybersecurity’s role is ineluctably bound to increase. Moreover, the move towards mobility, cloud, and work-from-home is creating a significant discontinuity in the way cyber-defenses are built, a transition many businesses and governments have yet to start. Our thesis is confirmed by several recent reports that found that in 2020 the number of identity theft reports in the U.S. have doubled to 1.4mn, over $4.2bn was lost to scammers, and ransomware demands increased by 320%.

The WEF (World Economic Forum) ranks “massive data fraud” among the top five global risks. Moreover, the costs of data breaches are rising. As customer data remains the most expensive type of record ($150 cost per lost or stolen record), companies will not spare investments to avoid a theft-related reputational blow or legal issues. Therefore, we firmly believe that the evolution of the digital landscape will support cybersecurity players. The recent $12.3bn acquisition of Proofpoint by private equity player Thoma Bravo confirms the opportunity and underpins the upside potential.

In the Space sector, private launchers now have all the support required to accelerate their development, either through listings (Rocket Lab, Astra), private funding (Firefly), or decade-long contracts (ABL). As a result, they are paving the way for cheaper and easier access to space.

In the meantime, SpaceX has exceeded our most optimistic expectations by being the sole winner of NASA’s lunar lander competition and is pursuing the deployment of its Starlink constellation, inflicting slap after slap to legacy players. Finally, space tourism is about to become a reality, with the first commercial flights of Blue Origin starting in July and a historical private orbital flight to launch in 4Q21.

Our takeaway

Cybersecurity has become a stated priority of the new U.S. administration following the SolarWinds attack. We continue to believe in solid prospects for cybersecurity companies, notably the new generation of cloud-native players extensively using Artificial Intelligence and Machine Learning techniques. In the meantime, we believe the space cycle is only beginning and that the SPAC bubble is only a temporary blip in the long-term development of the new space industry.

Sustainable Future

While a few recent events temporarily impact industries within our Sustainable Future universe (notably renewables and electric vehicles), we believe that the fundamentals remain strong and technology adoption will keep accelerating in the foreseeable future.

What happened

The ongoing semiconductor shortage impacts many industries, going from electric vehicles (EVs) to solar power inverters, leading many companies unable to meet rising customer demand and providing conservative guidance.

On the other hand, rising interest rates have impacted the renewable industry, as many projects use debt financing to pay high upfront costs. Whether it is at a utility or residential scale, the dynamic remains the same.

Impact on our investment thesis

As detailed in our latest Investment Recipes, the semiconductor shortage has a broad impact on the automotive industry (e.g., Infineon expects that “2.5 million cars won’t be produced in the first half of 2021 due to ongoing supply chain shortages”). The current demand/supply imbalance leads to temporary price increases, longer lead times, and supply constraints. However, our investment thesis remains unchanged: governments are still driving the EV uptake through various infrastructure investments and supportive policies. At the same time, automakers maintain their electrification plans, and ongoing R&D in battery technology is driving EVs prices down. The transition towards EVs remains solid and is gaining steam.

Solar and wind energy projects’ profitability is quite sensitive to interest rates, and rising interest rates theoretically translate into higher energy costs. However, one should keep in mind that beyond the fact that rates are still near historic lows, solar & wind power technologies are more competitive than ever, and political support continues unabated. The demand is to remain strong, driven by increased consumer adoption and large-scale government-driven investments.

Our takeaway

We believe that the fundamental drivers of our theme remain valid and that the current market correction is only temporary.

Globally, most big economies (incl.: U.S., E.U., China, Japan, etc.) embrace the climate issue and recently unveiled more aggressive emissions targets and supportive measures to the cleantech industry ahead of the upcoming COP26 conference in November.

Explore:

Disclaimer

This report has been produced by the organizational unit responsible for investment research (Research unit) of atonra Partners and sent to you by the company sales representatives.

As an internationally active company, atonra Partners SA may be subject to a number of provisions in drawing up and distributing its investment research documents. These regulations include the Directives on the Independence of Financial Research issued by the Swiss Bankers Association. Although atonra Partners SA believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this report.

The information contained in these publications is exclusively intended for a client base consisting of professionals or qualified investors. It is sent to you by way of information and cannot be divulged to a third party without the prior consent of atonra Partners. While all reasonable effort has been made to ensure that the information contained is not untrue or misleading at the time of publication, no representation is made as to its accuracy or completeness and it should not be relied upon as such.

Past performance is not indicative or a guarantee of future results. Investment losses may occur, and investors could lose some or all of their investment. Any indices cited herein are provided only as examples of general market performance and no index is directly comparable to the past or future performance of the Certificate.

It should not be assumed that the Certificate will invest in any specific securities that comprise any index, nor should it be understood to mean that there is a correlation between the Certificate’s returns and any index returns.

Any material provided to you is intended only for discussion purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security and should not be relied upon by you in evaluating the merits of investing inany securities.