Healthcare Companies: Get Ready For A Bipartisan Agreement Over Drug Pricing!

20 September 2019

Healthcare companies: Get ready for a bipartisan agreement over drug pricing

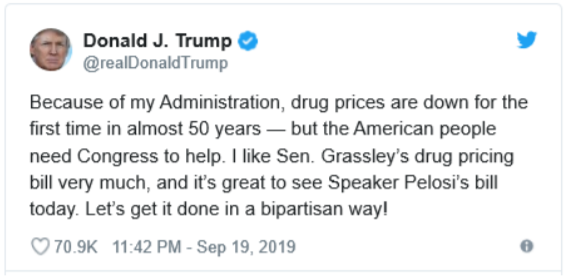

Healthcare stocks have recently been suffering from the political environment in the United States ahead of the 2020 presidential election. Much of the performance weakness is linked to the discussions related to drug pricing. However, several plans that would remove this uncertainty have recently been announced, and President Trump showed optimism about these plans:

Reducing the cost of prescription drugs is a popular goal with bipartisan support. However, the way to achieve it has not gathered a majority at the Congress yet. Senator Grassley’s plan focuses on capping drug price increasesto inflation, for all drugs covered under Medicare Part D. This part of Medicare is an optional federal-government insurance to help beneficiaries pay for self-administered prescription drugs. In 2016, the U.S. government spent nearly USD 100 billion in Part D, while it spent around USD 29 billion on prescription drugs in Part B, which is included in the traditional Medicare program offered directly through the federal government.

The proposal of Nancy Pelosi, Speaker of the Houser of Representatives, goes a few steps further. In an effort to be aligned with the recent ideas formulated by the White House, the plan aims to cap U.S. drug payments for Medicare using a blend of foreign prices. Specifically, the federal government would be allowed to negotiate the cost of up to 250 prescription medicines that do not face market competition – e.g. insulin and many cancer drugs, using the international price as a maximum price.

The negotiated price by Medicare would then be passed on to the other insurers. If a

pharmaceutical company refuses to negotiate the drug price, it will face fees and penalties. Negotiations would cover a minimum of 25 drugs annually.

Moreover, Pelosi’s plan would cap the out-of-pocket fees paid by seniors on Medicare to USD 2,000 per year. Many people with disabilities who do not get low-income subsidies currently have to pay thousands of dollars annually as a participation to their treatment. Senator Grassley also recommends imposing a similar limit, with a higher cap at USD 3,100 per year.

Finally, the legislation seeks to limit the price increase of drug in Medicare to the inflation rate. Drug companies would have to pay a rebate of the entire price above inflation to Medicare, dating back to 2016. Up to 8,000 drugs may be impacted by this suggestion.

Progressive democrats estimate that Pelosi’s bill should target many more drugs than the 250 of the costliest drugs. On the other hand, Republicans think that the free-market system is at risk, if Medicare is allowed to negotiate drug prices.

However, we can note that Pelosi’s proposal shares many characteristics with Grassley’s. Reaching an agreement on drug prices is not a utopia anymore. Neither the Democrats, nor the Republicans have advantage to avoid a consensus before next year’s elections.

We strongly believe that an agreement is very close; it will be a major positive catalyst for the entire sector. Once the uncertainty over pricing will disappear, investor sentiment will significantly improve. Consequently, biotechnology and innovative health care companies should enter a strong phase of progression.

Explore:

Disclaimer

This report has been produced by the organizational unit responsible for investment research (Research unit) of atonra Partners and sent to you by the company sales representatives.

As an internationally active company, atonra Partners SA may be subject to a number of provisions in drawing up and distributing its investment research documents. These regulations include the Directives on the Independence of Financial Research issued by the Swiss Bankers Association. Although atonra Partners SA believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this report.

The information contained in these publications is exclusively intended for a client base consisting of professionals or qualified investors. It is sent to you by way of information and cannot be divulged to a third party without the prior consent of atonra Partners. While all reasonable effort has been made to ensure that the information contained is not untrue or misleading at the time of publication, no representation is made as to its accuracy or completeness and it should not be relied upon as such.

Past performance is not indicative or a guarantee of future results. Investment losses may occur, and investors could lose some or all of their investment. Any indices cited herein are provided only as examples of general market performance and no index is directly comparable to the past or future performance of the Certificate.

It should not be assumed that the Certificate will invest in any specific securities that comprise any index, nor should it be understood to mean that there is a correlation between the Certificate’s returns and any index returns.

Any material provided to you is intended only for discussion purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security and should not be relied upon by you in evaluating the merits of investing inany securities.