Covid-19 Vaccines: from dream to reality...

09 February 2021

In only a few months, the world went from a complete shutdown to having the first vaccines entering clinical trials, a record timeframe for the industry. In this article, we sketch the landscape of approved or in development vaccines, their efficacy, and estimated revenue.

Bottom line:

The most important vaccine effort ever launched on a global scale is unfolding before our eyes, yet the plethora of vaccine under development have blurred the information. A new vaccine technology, mRNA, has been leading the race. Two main players, BioNtech and Moderna (both in our portfolios), were the first to receive FDA approval last December. We continue to believe that mRNA-based vaccines offer competitive advantages in terms of efficacy and scalability.

Still in the early stages

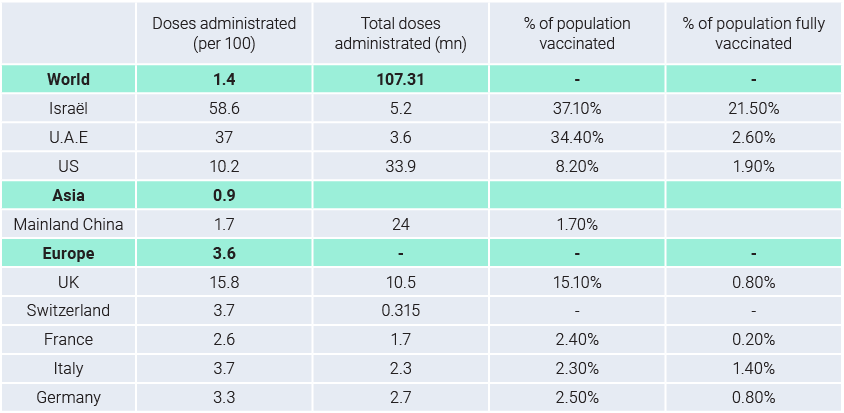

As shown in the first table, we are at the very beginning of the vaccination campaign. As of the latest data, ~107mn vaccine doses have been administrated so far, meaning ~1.4 doses per 100 people. Israel is leading the race in terms of the vaccinated population’s percentage.

Competitive overview

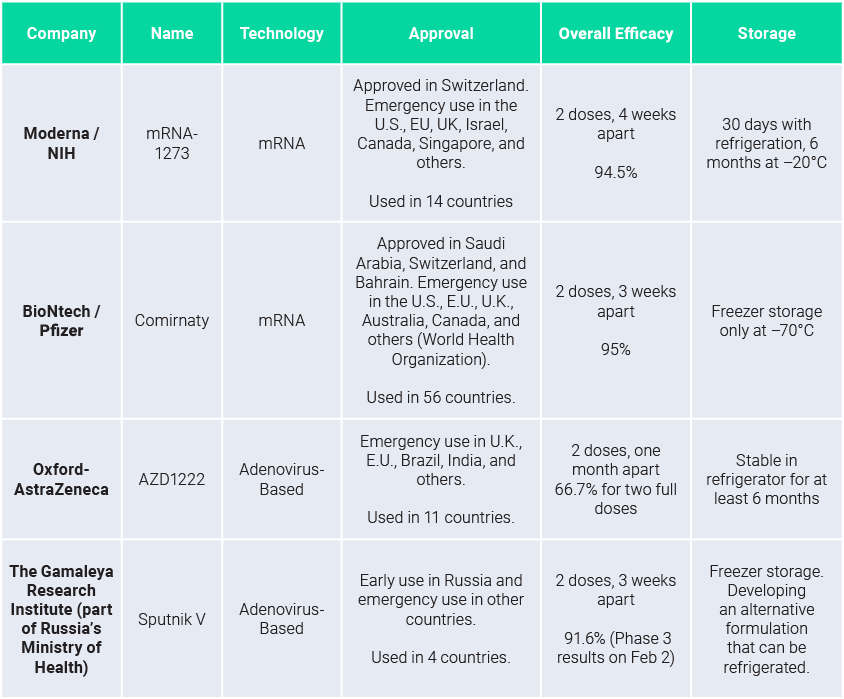

To better understand the current landscape in Covid-19 vaccines, we summed up the competitors, their underlying technologies, and their efficacy.

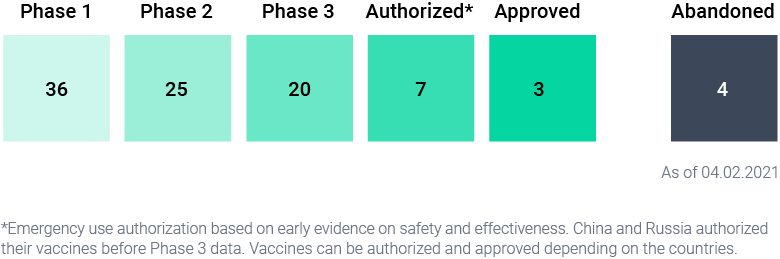

Today 67 vaccines are in clinical trials (human trials) and 8 are currently administered around the world, with Pfizer/BioNtech being the most widely used. Four have officially abandoned their Covid-19 vaccines efforts: Merck, Pasteur, Imperial College London, and the University of Queensland.

Leading vaccines – Approved or Authorized

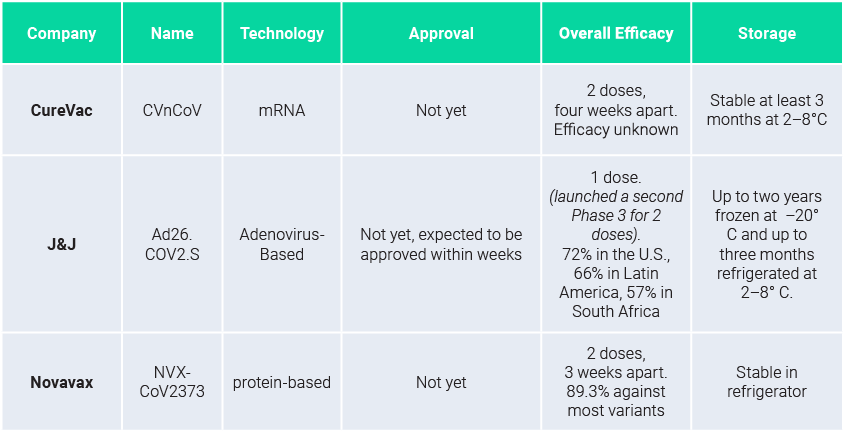

Leading vaccines – in Phase 3, but not yet approved

Vaccine technology snapshot

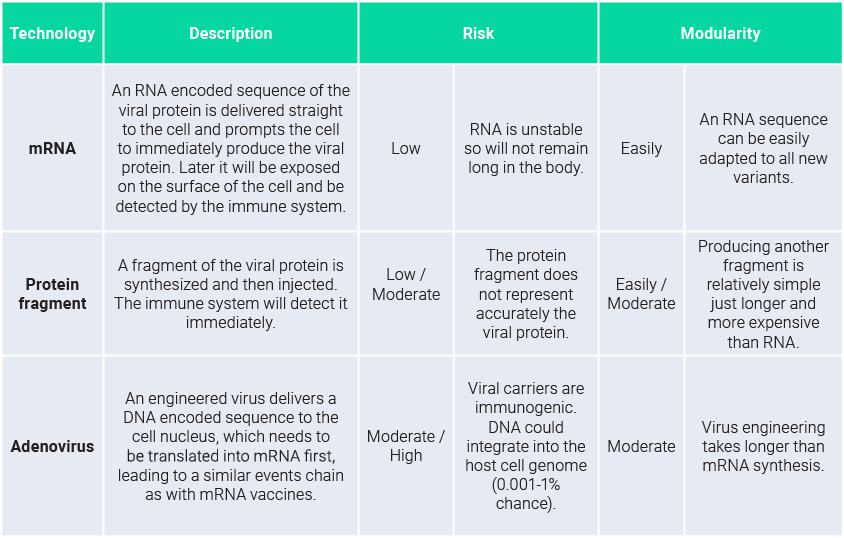

As a reminder, all vaccines rely on one thing: triggering the immune system to produce antibodies, which allow to trap/neutralize threats it binds to. Three main vaccine strategies are being developed: mRNA-based, adenovirus-based, and protein-based vaccines. They rely on presenting the same viral protein to our immune system: the spike protein. The common choice is based on 2 main factors: firstly, it is the most abundant protein accessible to the immune system when encountering the virus, and secondly it the “key” the virus uses to enter our cell, so it is functionally relevant. To present that protein to our immune system, the 3 strategies address it differently as shown in the table below:

mRNA vaccines are both best-in-class and first on the market

As of today, no vaccine has shown higher efficacy of protection (>95%) over the parent strain of Covid-19 than mRNA vaccines. As shown in the previous table, mRNA vaccines also represent the best benefit/risk balance.

Fast original Covid-19 strain sequencing and ease of RNA synthesis led to efficient and large-scale ready clinical trials, independently of the companies’ firepower. Both Pfizer/BioNtech and Moderna advanced at the same pace. This technological edge led both companies to be way ahead of the competition thus securing FDA Emergency Use Authorization and EMA Conditional Marketing Authorization months before the competition.

A continuous struggle with variants

The apparition of 3 Covid-19 variant strains sent a panic wave throughout the world – B.1.351 (the “SA” variant), P.1 (the “Brazil” variant), and B.1.17 (the “UK” variant). Vaccines were not yet ready to be deployed that variants were already appearing.

Companies quickly started testing their vaccines versus the variants. Novavax and J&J reported lower protective levels but still within an acceptable range for the three variants: ~60–80%.

Novavax announced its protein-based vaccine NVXCoV2373 showed efficacies of 85.6% against the UK strain and ~60% against the South Africa strain. Johnson & Johnson adenovirus-based single-shot vaccine candidate showed 72% protection against moderate to severe Covid-19 infections in the U.S. compared to 66% in Latin America and 57% in South Africa.

As for AstraZeneca, the preliminary results from a 2’000-participants trial in South Africa showed that the vaccine is 22% effective at reducing mild to moderate diseases. However, the small sample size makes it hard to interpret.

BioNtech and Moderna released only antibody titer (laboratory test measuring antibody levels), showing that current vaccines do trigger an immune response to the variant, but this information is not enough yet to precisely measure a protective level. In more detail, the Moderna vaccine produced equivalent neutralizing antibody titers against UK / Brazil variants and produced 6-fold lower neutralizing antibody titers against the South Africa variant. As for BioNTech / Pfizer, they stated that the vaccine produced also "slightly lower" (~0.81x) neutralizing antibody titers against South Africa but equivalent against the UK variant. While Moderna still plans to test the effects of an additional booster dose against emerging strains, and especially a booster dose targeting the SA variant, both companies said that "the flexibility of the mRNA vaccine platform is well suited to the development of new vaccine variants if needed".

So far, the results on the B.1.351 variant have shown a reduction in several vaccines' potency, but it is not yet clear to what extent. Our expectation is that mRNA vaccines will retain high efficacy and still prove more efficient than their competitors.

In our opinion, the mRNA technology platform possesses also one main advantage compared to its competitors: it may also be the best at producing a modulable multivalent vaccine. A multivalent vaccine is a vaccine protecting against several pathogens or variants in one dose. For mRNA vaccines, the cost to add several RNA variants of the viral protein within a single shot is cheap and easily scalable whereas competing virus engineering and protein fragment vaccines have higher technical limitations.

A lucrative market

As we anticipated, the Covid-19 vaccine market for mRNA players is expected to be a market of more than $10bn. BioNtech & Pfizer recently announced $15bn of 2021 sales and plan to produce 3bn doses. As for Moderna, with total doses expected to be between 500mn and 1bn, it could represent at least $10bn of 2021 sales.

The crucial question is what happens after 2021/2022. Assuming a protection period of 2–3 years and the emergence of new variants, recurrent vaccines and/or additional booster doses would be required. Although mRNA players will face increased competition from J&J, AstraZeneca, and others, mRNA platforms’ adaptability will remain an obvious competitive advantage.

In our portfolios, we were already exposed to mRNA technology, as well as to synthetic biology via RNA/DNA synthesis suppliers and to outsourcing of clinical research and manufacturing services – an all-round exposure to the emergence of this technology.

Thinking beyond 2020/21 Covid pandemic

Vaccines have been a cornerstone in the development of efficient public health campaigns against pathogens. Much as the Flu, which is now well monitored, well understood, and have vaccines as a disease mitigation measure, the Covid-19 virus (and its variants) will likely follow the same path: be chronically pandemic, be monitored, better understood, and have a batch of vaccines to mitigate the spread. We have learned to live with the flu and so will it be with Covid-19.

A glimmer of hope is that the pandemic highlighted the importance of technology in our life, whether through IT, Biotech, or Fintech. Homeworking and cloud computing are not just a thing to cope with during the pandemic. New tech in vaccines will not just be used for Covid-19. Access to new financing and payment options are just not for a lockdown period. Our approach as an early investor in budding technologies has been validated during the crisis, and we will keep looking for the next breakthrough technology.

Explore:

Disclaimer

This report has been produced by the organizational unit responsible for investment research (Research unit) of atonra Partners and sent to you by the company sales representatives.

As an internationally active company, atonra Partners SA may be subject to a number of provisions in drawing up and distributing its investment research documents. These regulations include the Directives on the Independence of Financial Research issued by the Swiss Bankers Association. Although atonra Partners SA believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this report.

The information contained in these publications is exclusively intended for a client base consisting of professionals or qualified investors. It is sent to you by way of information and cannot be divulged to a third party without the prior consent of atonra Partners. While all reasonable effort has been made to ensure that the information contained is not untrue or misleading at the time of publication, no representation is made as to its accuracy or completeness and it should not be relied upon as such.

Past performance is not indicative or a guarantee of future results. Investment losses may occur, and investors could lose some or all of their investment. Any indices cited herein are provided only as examples of general market performance and no index is directly comparable to the past or future performance of the Certificate.

It should not be assumed that the Certificate will invest in any specific securities that comprise any index, nor should it be understood to mean that there is a correlation between the Certificate’s returns and any index returns.

Any material provided to you is intended only for discussion purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security and should not be relied upon by you in evaluating the merits of investing inany securities.